Dear Reader,

For most Americans, it will mark the end of a long and prosperous era.

No longer will we give dollar bills to our kids for

their piggy banks. Small businesses won’t tape them up on the wall to

commemorate a first sale.

Carrying money simply won’t be necessary anymore.

Because that cash you now carry in your wallet will lose value – perhaps

all value.

Starting just weeks from now, a historic event will transform our money supply.

It will bring sweeping changes – to our investments and our way of life. As Yale economist and Irrational Exuberance author Robert Shiller says, “The economic revolution may be as profound as that wrought by our ancient ancestors’ invention of coins.”

Over the next few minutes, you’ll discover how a major

disruption to our monetary system will directly impact nearly

everything, from the politicians we elect to the coffee we drink, from

how much we can buy to where we shop. It will even impact our religious

institutions, our families and our lifestyles in retirement.

I believe that this event – more than any stock market

story – could prove the defining moment of our financial lives. Bigger

than the tech boom and bust... the bull market that followed... or the

crisis of 2008.

We’ve unearthed shocking intelligence, buried deep

inside the Federal Reserve in Washington, D.C. And it indicates exactly

how this event will create an economic shockwave worth $662 trillion

this year alone. In pure dollar terms, that eclipses the world market

for stocks ($54 trillion)... and oil ($3.2 trillion)... and gold ($2.4

trillion)... and new crypto-currencies ($6 billion)… combined... 10 times over. It will dwarf the whole economy of America ($16 trillion) and even the world economy ($69.9 trillion)... combined.

You will experience this event up close and personal.

You’ll see direct evidence whenever you go to the grocery store, the gas

station or your favorite restaurant... when you pay a bill, move money

around between accounts or add to your 401(k)... every time you buy or

sell an investment...

According to Fortune’s Miguel Helft, “What’s in play: millions of merchants, billions of transactions and trillions of dollars in commerce.”

The stakes could not be higher – for our investments and our families. And that’s why we’ve created this presentation.

Why I’m “Going Public” After 17 Years

My name is George Rayburn. You probably don’t know me. I’ve stayed out of the spotlight.

I’ve worked in the financial publishing business for more than a decade.

Today, I work here at the nation’s leading investment

think tank. Each day, more than 200,000 individuals and dozens of hedge

funds and institutions rely on our timely information.

We have guided them through every major financial event

of the past 23 years. The dot-com bust and the recovery... the demise of

Merrill Lynch and the old Wall Street order... the rise of China... the

crisis of 2008... and the surprise boom of 2009. It’s important to

note: We went on public record with every call – in some cases just days

beforehand.

But we’ve never witnessed an event quite like this – one powerful enough to transform the markets and human civilization.

On March 15, 2016, the Federal Reserve will push an audacious new program. Combined with other forces, it will radically disrupt the supply of physical money – cash and coins – in America.

And it’s going to change the balance of economic power in this nation like nothing that has come before.

We believe every American investor deserves to know

what’s coming. We can’t share this with our high net worth friends

alone. It’s just too important – and too big.

Over the next few minutes, I’ll present our evidence.

You’ll see exactly how this event will change our world over the next 12

to 18 months and beyond.

In the early stages, we will see fresh waves of

volatility rocking the markets. We’ll see enormous boom and bust cycles.

We could experience civil unrest, including protests outside banks and

possibly arrests on a grand scale. Some will fail to turn in their

physical money before the deadline, or watch their bank accounts go to

zero – overnight.

But this is not some doomsday scenario, not really. The

event you’re about to discover will bring crisis, but also historic

opportunity. It will transform almost every industry, economy and

society. It could even spawn new branches of human endeavor that will

lead us out of the current malaise.

We’ve created this presentation to ensure that you (and

your family) come out on the winning side. Along the way, you’ll

discover the simple five-step plan we’ve developed for our high net

worth readers... and it could mean the difference between losing almost

all of your money... our doubling your wealth as events unfold.

You won’t pay a dime for this research, either. We're on a mission to provide it to you, for free. Here’s why...

15 Months and $220,000 to

Create This Presentation

I learned the importance of financial stability at an

early age. My parents taught me the importance of shrewd money

management when I was still a youngster.

I carried that lesson with me. I entered adult life and

the world of financial research. There, I quickly discovered that the

financial system chews up hardworking people like you perhaps.

Over the years, we’ve helped expose countless government

boondoggles, bank scams and all the rest. We have dozens of

international power players on speed dial. The list includes famous

CEOs. It includes insiders from Wall Street. And it includes some of the

most powerful economic minds in the world.

All told, our team has spent more than 15 months and

$220,000 creating this presentation. Our research has led from the

central banks of Europe, Latin America and Asia to the stock markets of

Mumbai. Now the trail has doubled back on itself. And it ends in

Washington, D.C., site of the Federal Reserve Bank.

Very soon, this will serve as “ground zero” for an event I’m calling the death of cash in America. It will revolutionize our monetary system, and our daily lives, in remarkable ways.

After more than 200 years as the backbone of our

economy, the trusted greenback dollar will lose its status around the

world... but also right here in America.

You won’t hear about this ahead of time from CNBC or any

other mainstream source. But if you have even one dollar in your wallet

or bank account, you need to know what’s coming. It will be the most

important story about money we’ve seen in thousands of years. Here’s

what I mean.

The Most Important Investment Story –

Since the Age of Socrates

Since the dawn of mankind more than 20,000 years ago,

money has consisted of physical stuff. Stuff you can hold in your hands.

Stuff you can count and store and smell.

Early examples included obsidian, which ancient

Mesopotamians could use for tools and weapons. Other ancient economies

ran on grain, salt, cattle and cowry shells. Bartering was slow and

inefficient. It required what economists call a “coincidence of wants.”

But everything changed around 786 B.C. The world’s money

supply underwent its first radical disruption. The first coins sprang

into being along the shores of the Mediterranean.

The Lydian “stater” coin was made of electrum – a

natural mixture of gold and silver. Lydians could suddenly exchange

this new universal currency for anything they wanted. Farmers could buy

goods from leather workers (even ones who didn’t want cattle). Leather

workers could sell goods to common laborers. The effects were profound.

Lydia’s economy exploded. The new money accelerated the exchange of

goods, services and knowledge across the region.

The revolution sparked quantum advances in technology,

art, education, warfare and finance. Coins then spread to ancient Greece

by about 600 B.C. The new money – the drachma – spurred demand for

still more goods, services and technology. And from Greece flowed the

rise of Western Civilization itself.

But what does all this have to do with the event we’re about to experience?

For the first time since the invention of coins, our

money supply will undergo a complete transformation. It will start here

in America, bringing waves of disruption to our economy and our culture.

But it will spread worldwide quickly.

The time to prepare is now. Here’s why...

Overturning 2,699 Years of

World Monetary History

Since ancient times, physical money has afforded people a measure of security and power – and freedom – unlike anything else.

But for the first time in human history, our money supply is about to leave physical reality. Just days from now, our economy will begin a radical shift away from cash – and toward an all-electronic money supply. The transition to a cashless economy has been a long time coming. And the moment has finally arrived.

And that’s what we face now: the coming end of physical money in America. This is not a metaphor. We’re talking about the literal, physical death of the dollar.

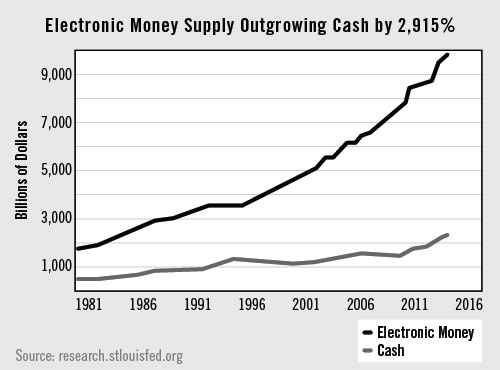

The American Institute for Economic Research reports that 93 out of every 100 dollars already exist electronically – only electronically.

That means 93% of our money supply has quietly

transitioned out of cash... and into ones and zeroes on computers around

the world.

Money’s transformation from the physical to the digital world has entered a rapid stage of acceleration.

According to The Wall Street Journal, our

supply of physical cash climbed 18% from 2009 to 2011. Using that same

data, the supply of digital dollars soared 2,915%, from $33 billion to

more than $1.2 trillion, by 2013. That means for every one physical dollar the government creates, it creates 162 electronic dollars.

“Currency and coin, as we know it, is going to be disappearing,” confirms Dr. Richard Rahn, senior fellow at the conservative Discovery Institute.

If that strikes you as incredible, think about this...

when economic slumps stretch out for years, that’s exactly when

governments are most likely to take extreme action. Look at what

happened the last time...

The Government Has Banned Our Safest

Investment Before... Remember?

The year was 1933. President Franklin Delano Roosevelt

faced an economy in shambles. Unemployment soared into the double digits

– and stayed there. Bankers leaped to their deaths in New York. Soup

kitchens and bread lines blighted cities around the country. The few

Americans with money refused to spend it. They preferred to store their

wealth in cash and gold.

But according to FDR, their safety-mindedness was

squashing all hopes of economic recovery. To spur spending, he took a

radical step.

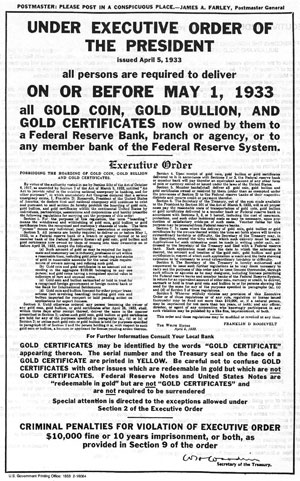

The announcement came in the form of Executive Order

6102. The president ordered all citizens to turn in their gold – to the

U.S. Federal Reserve Bank – before midnight on May 1, 1933. The penalty

for those who held on to their gold: $10,000 and up to 10 years in

prison.

I don’t know about you. But I am appalled at the notion of the government banning regular Americans from owning any asset – let alone the safest assets we have.

And I find it even more shocking that the ban remained in effect until 1974 – for over four decades.

But I bring this up now for a specific reason. According

to our intelligence, the government is about to launch an assault

against physical money. Unlike the gold ban, it could be permanent. This

event will ultimately lead to the death of money as we’ve known it for

hundreds – even thousands – of years.

The death of cash in America isn’t just on the horizon. For many people, it’s already here...

“Cashless is not only inevitable. For

most of us, it’s already here.”

~ CBS News Report

Last year, Madison, Wisconsin, banned drivers from

mailing in cash for any and all payments. If you’re dropping off trash

at the dump in Bridgewater, Massachusetts, don’t bother bringing cash.

As the sign says: “ABSOLUTELY NO CASH WILL BE ACCEPTED!!!!!”

As of February 1, 2012, the Maryland state Comptroller’s

Office outlawed all cash payments at branch offices – statewide.

Whether you’re paying taxes, traffic tickets or zoning fines... your

cash is no longer accepted.

But it gets worse...

Thanks to state bill R.S. 37:1866, you can now be

arrested in Louisiana for paying for secondhand items... with cash. As

the final version of the bill reads: “A secondhand dealer shall not

enter into any cash transactions in payment for the purchase of junk or

used or secondhand property.”

Businesses have also joined the cashless craze.

Washington, D.C.’s Snap Café no longer accepts cash for coffee or any other item on the menu.

Stop in at the trendy Café Grumpy in NYC and enjoy a

cappuccino. But don’t bother with your wallet. This all-American eatery

doesn’t take cash either.

But not only are local businesses banning cash. The

biggest company in America – and one of the biggest on Earth – has also

gotten on board.

During a recent iPad product launch, Apple quietly

instituted a new policy. It would ban cash for all purchases of the new

gadgets. The idea was to speed up purchases and enforce the company’s

limit of two units per customer. Diane Campbell, a lady with

disabilities on a fixed income, saved up $600 in cash for her purchase.

When she got to the counter of the company’s flagship store in Palo

Alto, they turned her away cold.

Luckily, cash users can always take their money to the

bank, right? Not anymore. When even banks are turning away cash,

we believe we’ve reached a tipping point in this historic move away from

physical money.

Take a look...

Detained by Police... for Trying to Pay Cash?

After years of service to his community, Lakeport,

California, resident Robert Somerton found himself humiliated, turned

away – and detained by police. This hardworking firefighter’s crime?

Trying to use cash to pay the mortgage at his local Bank of America.

And Somerton is not alone. Countless other Americans are

showing up at banks, government offices and businesses... only to have

their cash rejected. A report from CBS Sunday Morning says it clearly: “Cashless is not only inevitable. For most of us, it’s already here.”

But these incidents represent the calm before the storm.

Very soon, the Federal Reserve will make a historic move away from cash

and toward electronic money. It will accelerate the shift to a cashless

America at light speed. Some investors will get killed; some will get

very rich. So how will it unfold, and what does it mean to us as

investors?

The Three Phases of a Monetary Revolution...

Our research into the 2,699-year history of money has

revealed a distinct pattern. In almost all cases, major monetary shifts

occur in three phases.

Phase 1 is Denial and Disruption: The

herd goes into denial about what’s happening. It clings to that denial

even as the new money disrupts and begins transforming the economy.

Those who don’t adapt get crushed or left behind. We’re entering this

phase now. As we’ve seen, our government is creating new electronic

money 162 times faster than physical cash today. It has already fueled

everything from the real estate bubble to the crash of 2008. But these

were just the first warning signs.

Phase 2 is Profusion: The new money

gains acceptance. People discover that it’s easier to exchange,

transport and store. The government responds by exploding the money

supply – and government spending. The idea is simple: Fuel spending,

spur economic growth and increase government control of the economy.

Phase 3 is Acceleration: In the final

stage, the new money accelerates the exchange of goods, services and

ideas throughout the economy. Over time, this also transforms the

economy and civilization itself. Remember what happened when coins burst

on the scene along the Mediterranean some 2,700 years ago?

As Yale’s Robert Shiller writes:

Two benefits of electronic money stand out, and will likely contribute to its growth. Most important, it will have profound intellectual benefits by creating incentives for the active pursuit of ideas.

Second, electronic money will advance globalization, expanding the

scope and versatility of the Internet and making it easier for people to

interact constructively with others around the world. Taken together,

these two benefits will enable millions of minds to work together far

more effectively than ever before.

But here’s the bottom-line question for us as investors:

What does this event mean for our long-term wealth – and our lives? And

how can we best prepare? Consider this...

How the Death of Cash Could

Accelerate Business by 25,823%

You wake up in the morning to the alarm on your

smartphone. Before getting out of bed, you use your smartphone to check

your Trading.com account. One of your positions has hit its sell price.

You tap a button and sell 100 shares for $5,922... before getting out of

bed. The shares disappear from your trading account. The “money”

magically appears.

On your way to the office, you stop by Starbucks for a

coffee – paying with a bank card. While you wait, you use your phone to

download an old favorite song from iTunes.

But what does all this have to do with changing the course of our civilization?

At no point did you touch or exchange physical money.

You never went to a bank or took time withdrawing cash. You didn’t spend

time at your broker’s office to execute that trade. You didn’t have to

call him on the phone, either, or sign any papers. He never saw the

trade personally, so he spent no time processing it. Everything happened

electronically – automatically. You saved time – perhaps an hour’s

worth. You also saved gasoline and mental energy.

When you multiply such efficiency over billions of people – and trillions of transactions – efficiency explodes.

According to the British Financial Services Authority, electronic payments process in about one-seventh of one second – or about 130 milliseconds. The average cash transaction takes 33.7 seconds. Merely switching to electronic money can accelerate transaction times by 25,823%.

On March 15, the Fed will deliver a shocking

announcement. It will trigger the final stages of the greatest event in

monetary history... the death of cash in America.

And I can assure you the time to prepare is now.

“We simply use the computer to mark

up the size of the account.”

~ Former Fed Chairman Ben Bernanke

Spend enough time in Washington’s halls of power today

and you’ll notice something very strange. The Federal Reserve Bank is on

the tip of every tongue. It has grown more powerful than ever before.

During the crisis of 2008, who was in the room with

President Obama as events unfolded? Who strong-armed Bank of America

into buying Merrill Lynch? Who pumped hundreds of billions in pure

electronic cash into the economy, without ever having to clear it with

the president or Congress?

Only one person has that kind of power. I’m talking about the chairman of the Federal Reserve.

With the shift away from physical money, the Federal

Reserve has found a new source of power – the “digital printing press.”

It created as much new “money” as it wanted – for eight straight years –

with a few strokes on a computer. As former Fed Chair Bernanke himself

said in a report by The Wall Street Journal:

The [private] banks have accounts with the Fed,

much the same way that you have an account in a commercial bank. So, to

lend to a bank, we simply use the computer to mark up the size of the

account that they have with the Fed. It’s much more akin to printing

money than it is to borrowing.

As economist Harley Hahn writes, “The Fed doesn’t really have the money; the Fed just makes it up.”

After the financial crisis of 2008, the Fed “made up”

about $3.7 trillion on its computer. It pumped that electronic money

into the banking system and received bonds and mortgage-backed

securities in return. Armed with cash, the banks could now lend out 10

times the amount of electronic money they received!

How is that possible? The Fed requires banks to have

only $10 in their vaults for every $100 they lend. With each new loan,

new electronic money is created – along with new debt. Can you see how

this has helped to create cycles of boom and bust – everything from the

tech wreck, to the housing boom and bust, to the crisis of 2008?

And of course, Fed bucks have fueled the raging bull market that began in 2009.

Now that the stock market is cresting to new highs (and looking very frothy)... the picture is changing.

Or at least that’s what you would think from the headlines.

New Fed Chair Janet Yellen has officially wound down the latest round of quantitative easing (QE) cash injections.

But now that the Fed has let that genie out of the bottle, it will NEVER go back in permanently.

We predict we will see endless waves of additional QE in the future.

For example, if the stock market crashes... and housing reverses...

Or deflation hits the American economy, for real...

Or GDP drifts lower again for a couple of quarters, paired with a rise in unemployment...

All of these things WILL happen in the future. We cannot say with certainty when they will happen. But they will.

And when they do, the Fed will dump billions... even trillions of new electronic money into the supply.

The expedited death of cash is, in other words, inevitable.

Fact is, there’s very little we can do about it. Thanks

to the bizarre wording of the 1913 Federal Reserve Act, the Fed operates

without direct oversight from Congress or the president.

We believe this amounts to a monetary coup d’état. The Fed has seized almost total control of our money supply, without any checks and balances.

It can pump money instantly around the globe, thanks to a little-understood computer system called FedWire.

127,022,420 Transactions – Worth

More Than $622 Trillion

Using its FedWire network, the Federal Reserve can now transmit money between every major financial institution in the world.

That includes thousands of banks such as First National American Bank

in East Lansing, Michigan (acct. #0724-1243-5), and Bank of America San

Francisco (acct. #1210-0035-8).

They also include Wall Street firms such as Morgan

Stanley, HSBC America, JPMorgan Chase, Citibank and Deutsche Bank. Tiny

FedWire capillaries pump money into the world’s tiniest banks, too, such

as the Safeway Employees Credit Union of Los Angeles and the Tempe

Schools Credit Union.

Every single major financial institution on Earth now

transmits commerce via FedWire: Ginnie Mae... Freddie Mac... Fannie

Mae... the U.S. Treasury... the Asian Development Bank... the list goes

on.

FedWire also serves as the hub for the world’s

electronic central banking system today. You have the People’s Bank of

China... the European Central Bank... the Bank of Japan... the Central

Bank of Brazil... the Saudi Arabian Monetary Agency... the Swiss

National Bank... the Bank of Central African States... all connected

through this single computer network.

In the background of our financial system, FedWire now processes more than 127,022,420 transactions per year. The average value of these transactions: $5.23 million.

Last year alone, FedWire facilitated more than $713.3 trillion in new commerce. And we expect it to reach similar heights in 2016.

And we believe the next big wave could hit on or around March 15.

Here’s what the coming event means for us as investors, and exactly how we recommend our readers prepare.

How the Fed Is About to Trigger

the Death of Cash

The Fed unleashed the first stages of a radical new

policy. We’re not just talking about QE. We’re not merely talking about

lowering interest rates to zero, or bond-buying schemes to manipulate

the economy.

I’m talking about what the Fed is really doing through

these programs: ramping up the creation of new, electronic money on a

grand scale, never before seen.

With the first two rounds of QE after the 2008 crisis, the Fed added more than $2.1 trillion to the electronic money supply.

But now the Fed is doing something unprecedented, even by its standards.

It has been printing 40 billion electronic dollars every

30 days. And that’s in addition to the standing policy of pumping $45

billion a month into mortgage-bond markets!

As the Financial Times reports,

Combined with its purchases of long-dated

Treasurys under the Operation Twist program, the Fed will be buying

assets at a pace of $85bn a month. Unlike previous programs, the Fed’s

third round of quantitative easing – nicknamed QE3 – does not have a

defined limit and will continue until the labor market improves.

Although the Fed has publicly ended QE3, here’s the

truth. Not only does it have its foot on the gas pedal with

zero-interest-rate policies...

But it also stands ready to fire up the QE money machine

whenever the economy stumbles... Washington needs a political boost...

or the bankers come calling...

The fact is QE is here with us – to stay. We’re talking

about decades of roller-coaster economics, stock rallies and crashes and

– eventually – massive inflation.

After all, Washington’s debts are so large (and still

growing) that they can’t possibly be paid off with “real” dollars. We’ll

just keep transferring digital dollars back and forth. Meanwhile,

what’s happening to our money supply? The answer: The percentage of

cash, already in the single digits, is vanishing before our very eyes.

As the Fed’s master plan unfolds, our old cash-based

economy will finally disappear. In its place, we’ll see the rise of the

cashless society.

According to our intelligence, the Fed will confirm

this “easy money” policy at its March 15 meeting in Washington, D.C.

Even if it doesn’t restart its bond-buying program, the underlying

policy will remain intact – zero-bound interest rates, free electronic

money for all!

We believe the announcement will lead to huge new cycles

of boom... and eventually, bust. We’ll see raging bull markets followed

by intense bears. We’ll see housing rebounds and housing swoons. We’ll

witness steeper hills and valleys – across almost all markets – than

ever before. But long term, we could also see the creation of whole new

areas of knowledge, new industries and new civilizations. And we might

even live to see the world’s first trillionaire.

The only question that remains is: How can you prepare now to protect your family, and even profit, as the shift unfolds?

Here’s everything you need to know...

How You Can Prepare for This Event Now

For starters, you need to understand what the Fed’s done

with all that electronic money. It’s pumped trillions into the already

bloated market for U.S. Treasurys. The false demand has created a

historic bubble – on the verge of collapse. If you have exposure to

benchmark 10-year or longer-term bonds, we suggest getting out now.

Shift your portfolio to shorter-term securities,

maturing in one to five years. When the bubble explodes, it will wipe

out trillions in wealth. And you’ll save yourself a 30% to 50% haircut.

What’s ironic – and tragic – is that so many individual

investors have gotten sucked into the lie that Treasurys are “risk

free.” But as with cash, they are sitting on a financial time bomb. And

when it blows, it will take down millions of investors – and probably

some big Wall Street banks, too.

The cashless revolution will bring countless threats and

challenges. A cashless world would mean the death of financial privacy.

Governments and private corporations alike would have complete access

to every transaction we make – where, when and what was purchased.

Inflation could run rampant, as each new wave of

electronic money undermines the last. We could see “reverse bank runs,”

with customers storming banks, trying to turn in their cash. Things will

no doubt get very, very strange – quickly.

In the coming days, we’ll monitor these threats and advise our readers every step of the way.

Five Steps for Surviving the Death of Cash

But more urgently, we’ve developed a simple five-step

plan you can start using today. It will help you protect your family and

profit handsomely as this event unfolds. Let’s take a closer look at it

now...

STEP NO. 1: SECURE YOUR “PERSONAL MONEY SUPPLY”

Of all the solutions to the problems we’ll face from the

death of money, one stands above all the rest. If you use this

investment properly, it can protect you from market volatility...

inflation... lack of privacy... confiscation of cash... and all the

rest.

We’re talking, of course, about gold. But here’s the

problem. More than 85% of investors are going about gold investing all

wrong.

In fact, by owning gold for the wrong reasons – and in the wrong amounts – you could be adding risk to your portfolio with gold!

That’s why we’ve created our brand-new investment guide called “The Oxford Club Guide to Gold.”

This full-length manual outlines a precise plan for

owning and profiting from gold. You’ll discover our proven strategy for

investing in the yellow metal. We’ll show you precisely what percentage

of your portfolio should be in gold, for maximum safety and profits. And

you’ll discover the best gold investments to own now, as the death of

cash takes hold.

What’s more, “The Oxford Club Guide to Gold” will reveal to you the most common mistakes gold investors make, and how to avoid them.

Fact is, gold can save a portfolio – or destroy it. It all depends on how

you invest. This guide lays out a simple game plan – right down to

specific investments – to slash your risk and double your potential

gains.

And I’d like to send you a copy of this blockbuster gold guide for free today.

STEP NO. 2: LET THE FED FUND YOUR RETIREMENT

We’ve already shown you how the world’s central banks

are going wild, adding trillions to the electronic money supply. So the

question is: What is the most direct way you can safely collect some of that easy money for your own portfolio?

Just follow the money. The Fed used most of that money

to buy Treasurys and mortgage bonds – also called mortgage-backed

securities (MBS). When the Fed creates artificial demand for mortgage

bonds, it drives bond prices up – but interest rates down. It’s working.

The Fed is driving down interest rates to historic lows.

That’s keeping rates low for homebuyers. And profits are now exploding

for a small niche market within the banking sector: mortgage lenders.

Since these banks make their money on the “spread”

between their borrowing rates and those of their customers... they’re

making an easy killing.

With the Fed keeping interest rates near zero, the

lenders’ spreads are huge. That’s leading to record profits and insane

margins. Consider this: During the decade from 2000 to 2010, mortgage

banks collected an average “spread” on their loans of 0.5%. Today, that

spread has more than tripled... to 1.6%.

Indeed, and that is about to send shares of one mortgage

lender through the roof. I must warn you: This is a tiny company and a

speculation. It measures its market cap in the millions. Yet it stands

first in line to collect from a money-supply explosion worth trillions

of dollars.

The mere announcement of QE3 caused a double-digit spike

in this company’s stock. In the coming months, those gains will go much

higher.

This tiny firm has seen revenues from new loans soar in

the last 12 months. Its overall loan portfolio has ballooned 77%, and

income has rocketed 104%. In the most recent quarter, loan volume hit

the highest level in company history!

According to our research, the company has just secured a

deal that will expand its revenue base exponentially. As long as the

Fed keeps interest rates low, the bottom line stands to burst higher.

The time to get in is now.

That’s why we’ve created another new research report called “How You Can Ride ‘QE Infinity’ to Huge Profits.”

I’d like to send you a copy of this report right away, for free. But there’s something else I’d like to send you, too.

STEP NO. 3: RIDE THE DEATH OF CASH – SAFELY – WITH “SILVER STREAMING”

Like gold, silver has served as money for thousands of

years. As our money supply transitions to the electronic world, owning

silver will make even more sense.

Silver also happens to be dirt cheap right now, even

compared to gold. And it has proven capable of multiplying your money

three, four and five times over – quickly.

From 2008 to 2011, for example, silver skyrocketed 448%.

After the Fed announced QE1, silver jumped 69%. It rose nearly 82%

after QE2 kicked in.

But what most investment newsletters won’t tell you

about silver is this. All of this sky-high potential comes with a

downside. Silver can be volatile. Over the past two years, silver has

gone down 50% as of this writing.

Frankly, you can lose your butt investing in silver if

you don’t know what you’re doing. That’s why we’ve created another

brand-new report for Members only.

It’s called “Three Safe Ways to Profit From the Coming Silver Boom.”

I think it’s the best work we’ve done on silver in our

23-year history. Not only does it reveal how the silver markets really

work, it also details the three safest, smartest ways to invest in silver now – while still having the potential to double your money or more.

One of them lets investors buy real silver for $4 per ounce... instead of $18.

I’m not talking about silver coins or bullion or

certificates. I’m not talking about risky prospecting, or mines in the

middle of nowhere. This company profits from silver in an ingenious new

way. It’s called “silver streaming.” Here’s how it works.

The company starts by making loans to miners. (Of

course, it will be loaning electronic money, over electronic networks.)

In return for the loan, the miner agrees to sell some of its silver back

to the streamer... for between $3 and $4 per ounce.

By investing in the streamer, you can essentially own silver at an 80% discount.

That brings a margin of safety most investors will never

see with silver investments. This is just one of the unique

opportunities you’ll discover in “Three Safe Ways to Profit From the Coming Silver Boom.”

I’ll send you this report for free, too. But that’s not

all. Let’s take a look at the next step in our plan for riding the

biggest monetary shift since the age of Socrates.

STEP NO. 4: COLLECT YOUR SHARE OF BILLIONS OF CASHLESS PAYMENTS

As the world’s money supply leaves physical reality, it

will require a whole new financial system. I’m talking about the vast,

global networks that will process trillions of annual cashless payments.

Our research has pinpointed the three companies poised

to cash in first. They’re constructing electronic payment systems for

the world’s biggest businesses and governments.

The next time you shop for groceries, clothes, cars or

even a new home, chances are one of these companies will process your

payment.

And every time you do, the company will take a percentage cut of the transaction.

Over the course of a year, we’ll be talking about trillions of transactions and billions in revenue.

And we’ve isolated one firm that will see its payment

system installed in more than 1 million businesses, worldwide, by the

end of 2016. According to our research, it’s already sitting on a $590

million electronic-cash war chest. Right now is the perfect time to get

on board.

That’s why this company headlines another new report I’d like to send you today, for free. It’s called “Cashing In on the Cashless Payments Revolution.”

Inside, you’ll find our in-depth research on these

companies, and how even a tiny investment could turn into a $10,000

windfall or more. But there’s one final step in our strategy for playing

the death of cash.

STEP NO. 5: OWN THE TINY COMPANY THAT COULD SAVE AMERICAN CAPITALISM

As the money supply goes electronic, the criminals

follow suit. Over the past 12 months, the National Security Agency

estimates that Internet-based financial attacks have cost $1 trillion.

NSA Director Gen. Keith Alexander says these attacks will usher in “the

greatest transfer of wealth in history.”

In 2013 alone, electronic-money attacks soared 7,757%, according to security firm Prolexic.

And that’s why America’s most powerful companies are

about to dump a mountain of money on a tiny tech firm in California. It

has perfected the ultimate weapon against Internet-based financial

attacks. According to our research, the company is cementing contracts

with more than 400 of the Fortune 500 companies. We’re talking about one

tiny firm about to protect some $9.8 trillion in assets (measured in

market cap).

And our research shows that it’s about to lock up a historic wave of new business:

| Boeing | DEAL FINALIZED |

| Sprint Corp. | PENDING |

| Lockheed | DEAL FINALIZED |

| Hess Corp. | PENDING |

| Time Warner | DEAL FINALIZED |

In addition, the company is cementing contracts with

nearly every member of the Fortune 100 as well. These include Apple Inc.

(market cap $591 billion)... ExxonMobil ($406 billion)... IBM ($226

billion)... Microsoft ($253 billion)... and Chevron ($220 billion)... to

name a few...

Investors who get in before this tidal wave of cash hits

could pocket windfall gains. That’s why we’re putting the finishing

touches on a brand-new research report.

It’s called “How to Profit From the Digital Defense Boom.”

It details the three best investments for playing this aspect of the

shift, including the company prepared to secure the Fortune 500.

You can get this report – and all the others mentioned above – as part of something we’re calling the Death of Cash Survival Kit. I’d like to send you the entire kit today, for free.

All I ask in return is that you consider taking our research for a test drive.

Here’s what I mean...

How to Claim Your Personal Death of

Cash Survival Kit – for FREE

Some 25 years ago, we founded The Oxford Club with a

simple goal: help our small circle of readers protect their wealth and

profit through all markets. What’s important now is this. The death of

cash is not only coming... in many ways, it has already begun.

That’s why we’re about to release our new Death of Cash Survival Kit. The kit will go out free to new Members. It includes all the proprietary research I’ve mentioned so far... and much more.

Inside, you’ll find our simple strategy for protecting your family from the coming shift and profiting every step of the way.

But we realize that taking bold action now won’t be

right for some investors. We’ve met hundreds of good people over the

years, and some prefer to wait until the last possible moment to act.

Unfortunately, by that time, it could be too late to avoid major damage,

let alone profit.

However, if that describes you... then no hard feelings. You genuinely may not be right for this opportunity.

On the other hand, if you’re the kind of person who’s

not afraid to take control – before the mainstream herd catches on –

then I invite you to join us, today.

Simply agree to take our research for a test drive. You’ll receive your Death of Cash Survival Kit right away, for free. And that’s just for starters.

You’ll also receive weekly briefings via email on our

hottest open investment recommendations. You’ll know exactly what to do –

when to buy and sell – in real time.

In addition, with your subscription to The Oxford Communiqué

comes membership in The Oxford Club. And as a valued Member, you’ll

receive select invitations to join us on investment expeditions around

the world.

In the past, we’ve traveled to China, Europe and even

South Africa to unearth new investment opportunities. Along the way,

we’ve enjoyed the finest accommodations.

You’ll also gain automatic access to our private

clubhouses and offices in historic Mt. Vernon, London, Normandy, France,

and Melbourne, Australia.

The list of benefits goes on. You’ll read about all the details in your Membership Benefits booklet, included with your Death of Cash Survival Kit.

So how much does it cost to receive The Oxford Communiqué?

The normal price for first-year subscribers is just $149.

But you won’t pay $149. I believe the death of cash is

so important that every investor deserves a chance to survive and thrive

when this event hits.

So agree to try out The Oxford Communiqué today, and I’ll slash your first-year subscription to just $49.

That saves you nearly 65%. I hope you’ll agree that it’s a ridiculous deal.

And there’s one more thing I’ll send you when you sign up today.

It’s an unusual new report called “The RNA Interference Revolution: Your Ticket to Centuries of Health and Wealth.”

A new genetic treatment, called RNA Interference, is changing everything humans thought they knew about life and aging.

It involves a breakthrough technology... one that goes

deep inside the inner workings of our cells. This process doesn’t just

treat the symptoms of old age. Rather, it slows down, and in some cases

actually stops, the aging process itself.

What we’re looking at here is a possible cure for dozens

of major diseases that kill people daily. And one company stands to

make the lion’s share of profits from this phenomenon.

So how do you collect this report and everything else I’ve mentioned, now?

Simply click the ACCEPT NOW button below and follow the easy instructions.

Claim Your Kit Now – And Enjoy This

“Risk Free” Guarantee

One more thing: If for any reason you decide that The Oxford Communiqué is not right for you, simply contact us within 45 days. You’ll receive a full, prompt refund of your dues – no questions asked.

But I’m confident that won’t happen. I’m so confident,

in fact, that I’ll let you keep everything you’ve received – including

all the reports mentioned above – even if you cancel.

Simply click the ACCEPT NOW button below to get started.

Or you can call us toll free at 1.866.415.8492 (or internationally, 1.443.353.4234) between the hours of 8 a.m. and 8 p.m., Eastern Time.

Thanks for your time and welcome to the Club,

George Rayburn

The Oxford Club

January 2015

The Oxford Club

January 2015

P.S. To receive your FREE Death of Cash Survival Kit, please click here

and follow the simple instructions. You’ll receive an online version of

your kit via email immediately. But shortly after, you’ll also receive

your kit in a hardcopy version.

P.P.S. If you respond right away,

there’s something else I would like to send you, for free. Last year,

our experts handed readers gains such as 80% on Genuine Parts Co... 652%

on Hain Celestial Group... and 1,122% on Skyworks Solutions. And now

we’ve identified a company we think has similar potential. You’ll

discover why in our report “Hyper-Fi: The Patented Solution to Our $1.5 Trillion Problem.”

FINALLY, SAVE HALF OFF! Once more, I’m lowering your subscription dues by almost half, if you join The Oxford Communiqué today. Simply click here to lock in your savings now.

No comments:

Post a Comment